Retirement Plan Details

Plan Overview

Costco offers a comprehensive 401(k) Retirement Plan to help employees save for retirement through pre-tax contributions. The plan features company matching and annual contributions based on your years of service.

Eligibility and Enrollment

Who Can Participate?

Employees who are 18 years or older become eligible to participate after completing 90 days of service. However, union employees may have different eligibility rules, which can be found in the Summary Plan Description.

How to Enroll:

Employees who are 18 years or older become eligible to participate after completing 90 days of service. However, union employees may have different eligibility rules, which can be found in the Summary Plan Description.

Automatic Enrollment

- Employees who don’t elect their contribution percentage within 30 days are automatically enrolled at 4% pre-tax.

- Contributions are invested in a target-date fund based on your birth year.

- Pre-tax contributions automatically increase annually unless opted out.

Your Contributions

Contribution Limits:

- Up to 50% of your compensation per pay period.

- IRS annual maximum: $23,000 (2024), increasing to $23,500 (2025).

- Additional “catch-up” contributions for employees aged 50+: $7,500.

- Special catch-up contributions for ages 60–63 starting in 2025: $11,250.

Need access to your account funds? Costco offers loans and withdrawals under specific conditions.

Loans:

- You can borrow up to 45% of your vested account balance, with a maximum limit of $50,000. Loan repayments are made through after-tax paycheck deductions, and missed payments may lead to tax penalties.

Withdrawals:

- You can access funds rolled over from a previous plan through rollover withdrawals. At age 59½, you may withdraw any vested balance, with distributions limited to one per quarter. Hardship distributions are also available for significant financial needs, such as medical expenses or preventing eviction, but require strict documentation.

Company Matching & Annual Contributions

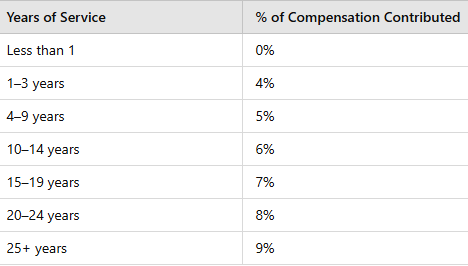

Costco matches a percentage of your contributions, up to an annual maximum. Annual company contributions vary by years of service:

Rollovers

Already have retirement savings? Rollover eligible contributions from:

- Former employer plans.

- Pre-tax IRAs.

Start Planning Today

Costco’s 401(k) Retirement Plan is designed to help employees secure their financial future with flexibility, support, and generous contributions.